Attract and retain top-tier talent through equity incentives

Startup India Registration

Startup is not just built on great ideas, but on the legal framework that supports it.

it's an investment in the future of your business.

Startup is not just built on great ideas, but on the legal framework that supports it.

it's an investment in the future of your business.

Ownership structuring and founder equity

IP protection strategy

Legal assessment of business feasibility

Sector-specific regulatory mapping

Advisory on scalability and compliance impact

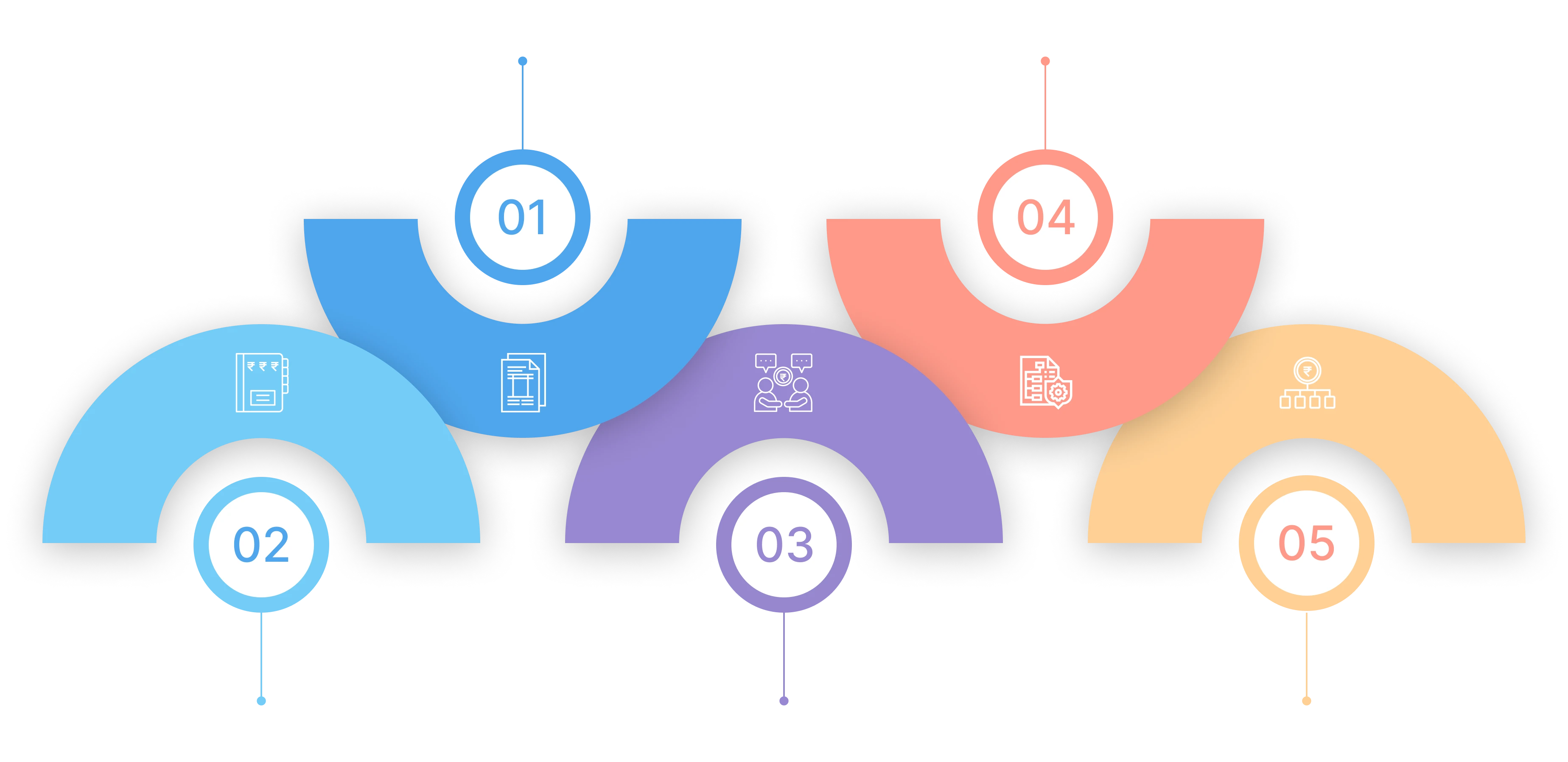

01

Attract and retain top-tier talent through equity incentives

02

Implement tax-efficient and compliant ESOPs

03

Avoid legal lapses in ESOP issuance and record-keeping

04

Create clear policies that align employee interests with growth

05

Receive support on ESOP buybacks, sales, or exit transactions

Eligibility assessment and legal structuring

Application filing with DPIIT

Business plan drafting for recognition

Clarifications and follow-ups

Integration with other government schemes

Access to tax exemptions and government incentives

Fast-track IP filings and patent application support

Enhanced investor appeal through official recognition

Unlock priority sector benefits and easier compliance

Reduce administrative burden through expert handling

Pre-funding structuring to avoid angel tax

Valuation support from registered valuers

Representations to CBDT for exemptions

Regulatory filings & documentation

Litigation support in case of assessments

Prevent tax disputes that delay or derail funding

Reduce scrutiny through structured share issuance

Ensure valuation compliance with Income Tax and FEMA

Protect investor confidence through proper documentation

Get expert representation in tax queries or appeals

Legal and regulatory due diligence

Contract review and risk mapping

IP and compliance validation

Financial audit coordination

Data room preparation for VCs and angels

Ensure smooth closure of funding rounds without legal delays

Identify and fix red flags before investor review

Gain higher valuation with strong legal hygiene

Build trust with investors through transparency

Reduce negotiation friction and avoid post-investment disputes

Drafting founder or investor exit agreements

Structuring payouts, earn-outs, and lock-ins

Managing IP and non-compete transfers

Board and shareholding restructuring

Legal compliance with exit processes

Secure the company’s interests during personnel or investor exits

Minimize disruption to business and operations

Ensure enforceability of post-exit obligations

Protect brand value, IP, and confidential information

Avoid litigation or arbitration through detailed terms

Legal readiness audits

SEBI and Companies Act compliance review

Governance and board structuring

Coordination with CS, merchant bankers, and auditors

Drafting offer documents and resolutions

Reduce listing delays with proactive legal compliance

Increase valuation with a clean legal and regulatory profile

Build investor trust with transparent documentation

Avoid rejection by stock exchanges and regulators

Position your company as IPO-ready in domestic and global markets

Legally compliant process that avoids regulatory scrutiny

Tax-efficient structure for founders and investors

Protects equity dilution and cap table integrity

Enables investor exits with clear documentation

Avoids future litigation by documenting buyback terms clearly