Income Tax e-Filing in India

Taxation is the lawful imposition of financial charges by the government to fund public services. Fixation refers to the legal determination of prices, rates, or values by an authorized authority.

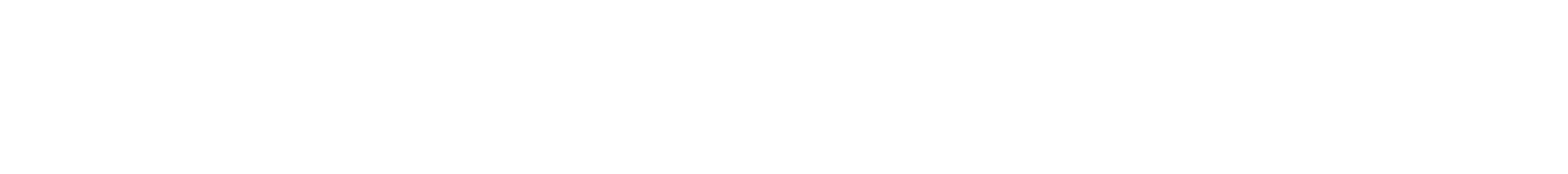

Income Tax Filings

Tax Saving Strategies

Transfer Pricing Compliance